24531 - The Eastern Mediterranean reserves, despite the low prices

are considered exploitable

E. Conophagos, N. Lygeros

Translated from the Greek by Athena Kehagias

Following the recent drop in oil prices at below $ 40 per barrel, oil experts and well-known journalists argued that the utilization of the Greek reserves within our country’s EEZ would be disadvantageous, as the production costs are extremely high.

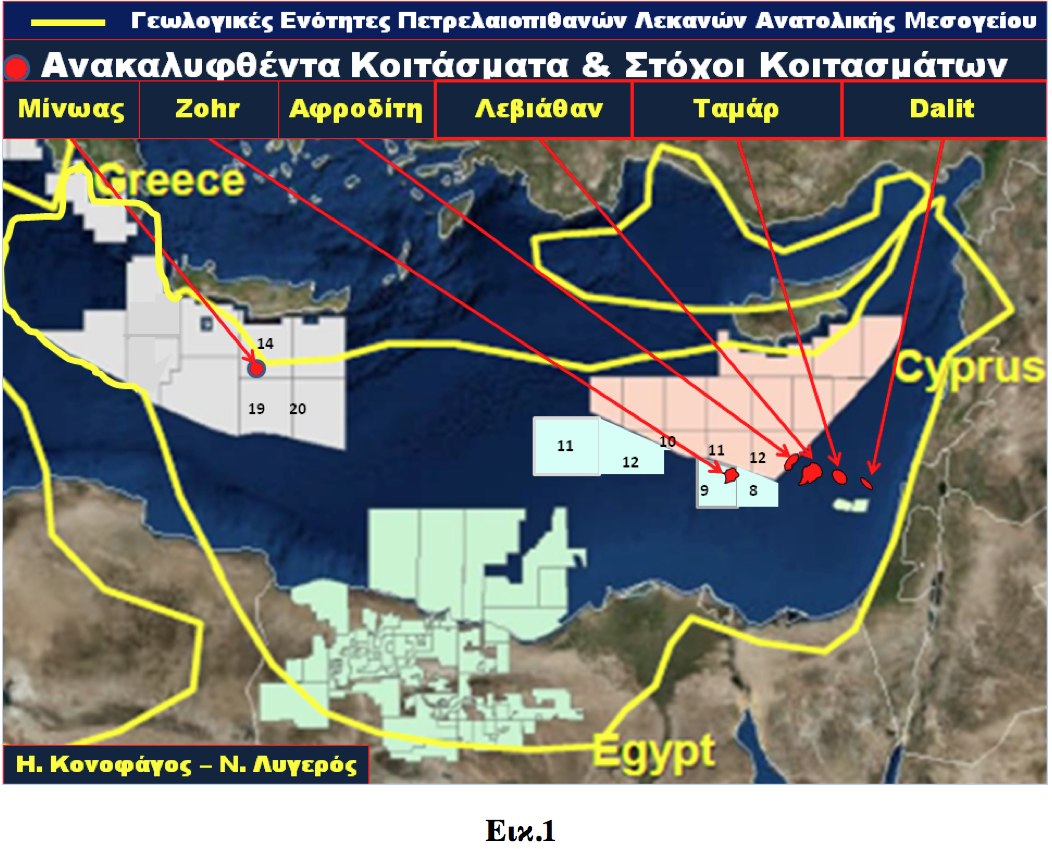

But the truth is quite different as we will indicate below. (Fig.1).

Only six months ago the hypergigantic Zohr reserve was discovered in our neighbourhood, with stocks which amount to~ 26 trillion cubic feet (Tcf), in water depth of ~ 1500 m, and drilling depth of 4,150 meters below the seabed.

According to the company ENI’s agreement with Egypt, about 40% of the natural gas production will be retained by the company going towards covering the development investment cost of the reserve, and the remaining 60% will be shared between ENI by (35%) and the Egyptian State by (65%).

The total anticipated development investment of the reserve is estimated at about $ 8 billion, whereas the total research costs regarding the location and the contour stripping of the reserve, amounts to $ 1 billion.

The annual operating costs of the reserve, has been calculated according to the international practice mode, and could reach the $ 1 Billion.

However, the duration of the reserve exploitation period is determined as per the contract, to 30 years from the initiation of the production.

Based on the above stated data we’ve calculated the Technical Production Costs (T.P.C) which is expected to be borne by ENI in regards to Egypt’s Zohr reserve.

We should state at this point, that the cost is calculated prior to any tax, shares, or hiring cost paying towards the State, and it is defined as the reason of the total research spending, development and exploitation, carried out for 30 years by the company ENI for the expected volume of natural gas reserves to be recovered from the deposit.

T.I.C. = Total Investment Cost, 30 years / Recoverable Stocks of Natural Gas.

That cost is expressed in $ / thousand cubic feet ($ / Mcf) or $ / per oil barrel respectively ($ / bbl).

It is obvious that the technical production cost should be considerably higher than the natural gas market price offered by the Egyptian government, in order for ENI to meet its financial obligations towards the State, and simultaneously to gain its proportional profit as well.

Taking into account that the Egyptian government will purchase natural gas from ENI at prices which will range, from a minimum of $ 4 / Mcf, to a maximum of $ 5,88 / Mcf, the expected technical cost should certainly be much lower than these prices.

Based on the technical and economic data of the Zohr reserve, we’ve calculated that the related technical production costs for ENI will come up to ~ $ 1.5 / Mcf, or ~ $ 9 / bbl respectively.

This -pre tax, shares & profit – cost, confirms that ENI’s investment in the hypergigantic reserve is quite interesting, even though the current natural gas import prices, as far as the European Union is concerned do not exceed ~ $ 6.24 / Mcf or ~ $ 39 / bbl .

Based on the above data we’ve examined the expected technical cost of much smaller in size deposits (with recoverable reserves of 2.5 TCF, instead of the 26 Tcf of the Zohr case), which could be discovered in the following drilling researches within the Cypriot, and or the Greek EEZ in similar sea depths (Fig.2).

Our calculations indicate that the technical cost of the reserves of this size is much higher, (~ $ 4.5 / Mcf) than the respective cost of the Zohr reserve. they could however be considered exploitable, despite the current low natural gas prices – if the natural gas volume per drilling is high (~ 1 mln. m3 / day), and if the contractual terms in regards to the distribution of the net production between the State and the contractor companies doesn’t exceed the ratio of 60% – 40%

We must however bear in mind, that even if 2 or 3 smaller adjacent economic reserves are discovered ( with stocks of ~ 1.5 TCF each), their coexploitation with mutual exploitation facilities, may result to an overall economic exploitation to take place.

All of the above require a greater flexibility to the related current legislation in regards to the Research and Exploitation re: the hydrocarbon reserves in both Cyprus and Greece.