30771 - What ought to be done following the degradation of the South of Crete underwater mineral wealth

Ε. Conophagos, N. Lygeros, A. Foskolos

Translated from the Greek by Athena Kehagias

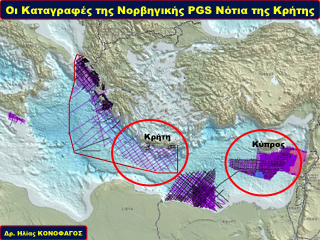

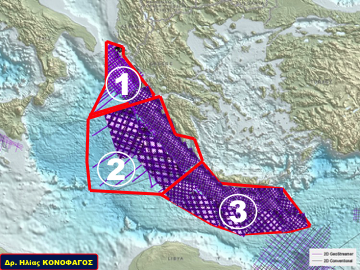

With our first illustration we remind you that, on the 30th of September in 2011, the Ministry of Energy issued an international licensing round regarding the prosecution of non-exclusive seismic surveys over a huge marine field of 220,000 square kilometers both in the Ionian Sea and South of Crete.

The aim of the Energean Ministry was to acquire new geological and geophysical data aiming as a result in attracting investments from Oil Companies for the detection of hydrocarbons.

Eight large companies responded to that licensing round with the corresponding offers re: network pursuance of two dimensional underwater seismic surveys.

Following an evaluation, the inference of these seismic recordings was assigned to one and only company, that been the Norwegian PGS.

Following the signing of the associated contract re: the prosecution of the seismic surveys, an economic inability of the Norwegian Company was ascertained, which found her incapable of utilizing a dense equable network of two-dimensional seismic surveys in the entire area of 220.000 km2.

PGS has therefore executed a fairly dense seismic recordings network in the northern Ionian Sea, and a very sparse network South of Crete.

The total length of the recordings which finally took place, is calculated in the range of 12,500 kilometers, whereas the initial contract was regarding 8000 km.

The Company was aware that in the case of the North Sea – contrary to that of the South of Crete – there had been previous extensive seismic network recordings.

PGS’s new recordings did cost more than $ 60 million and were incorporated in the package of older seismic records, so that the total of the underwater geophysical data would be able to be sold easier to oil exploration and production companies of hydrocarbon reserves.

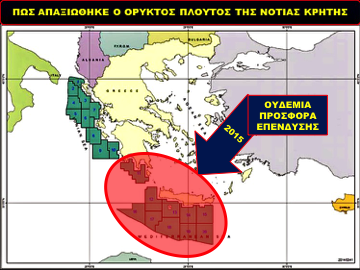

Based upon the seismic recordings of the 12.500 km executed by PGS, the Ministry of Energy launched an international licensing round on the 13th of November of 2014 re: the concession of 20 marine blocks both in the Ionian Sea and South of Crete.

There was a single tender from a foreign consortium re: marine block 2, and two offers by a Greek Company regarding marine blocks 1 and 10, which are located in the Ionian Sea.

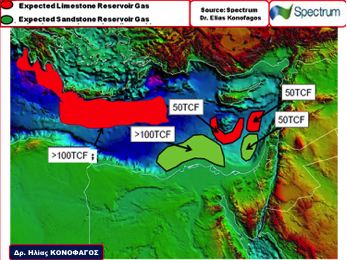

Surprisingly enough, the parcels South of Crete – according to all current statistics – had the potential of the existence of hydrocarbon reserves which could’ve been ten times larger in magnitude in relation to the probable Ionian Sea’s reserves, although there was absolutely no investment interest offers, if we were to forget that the new government and the new Ministry of Energy specifically, did whatever they could to cancel the licensing round, to delay it when it couldn’t stop it altogether, and finally to degrade it in every way it could.

And let’s now explain why six entire years were lost without any investors re: the hydrocarbon mineral wealth South of Crete.

The Ministry of Energy has failed to achieve the goals of attracting substantial research investments South of Crete, simply because it improvised, using inexperienced in actual fact cooperators.

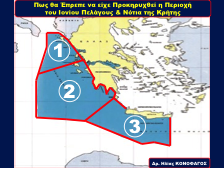

Therefore, instead of the Ministry of Energy assigning the investment obligation seismic surveys to three separate geologically regions, from three different companies in the Ionian Sea and South of Crete, it opted to bear down on a one and only subcontractor , ie, the PGS Company.

It’s obvious that if the investor subcontractors of the seismic surveys were three, that it would’ve been a significant chance that the two-dimensional seismic records network would’ve been denser in all three areas of interest in the Ionian Sea (1) + (2), and South of Crete (3).

This factor would’ve made the regions South of Crete much more attractive investment wise, given that it could reduce the investment risk of Companies by offering them more precise information regarding the existence of target hydrocarbon reserves.

A second but nevertheless important and crucial factor regarding the absence of major investment offers South of Crete, is the small size of the marine blocks, whose size doesn’t on an average exceed the 3,000 km2 per marine block.

The small size of the marine blocks is not at all attractive investment wise, since it constitutes a completely unexplored area.

The size of the marine blocks in the area should, according to existing geophysical data exceed the 10.000 km2.

According to the International Practice of the Hydrocarbon Industry, in order for Petroleum Research Company Investment and Production of underwater hydrocarbon reserves to be carried out, in an area where there aren’t as yet discoveries by the drillings of exploitable reserves -as is the case South of Crete – then, the region should have been scanned with a network of much more dense seismic surveys.

Simultaneously, in order to attract reliable large investors of a certain prestige from the global hydrocarbon market (ie. companies such as TOTAL, SHELL, EXXON-MOBIL, STATOIL, ENI, etc.) in Southern Crete, the investment interest should’ve been maximized by a call for tenders – as we have already mentioned prior – of greater in size marine blocks.